MUDRA LOAN SCHEME - SALIENT FEATURES

1. Brief background for introduction of MUDRA Loan Scheme by Govt. of India

As per NSSO survey (2013), there are around 5.77 crore small/micro units in the country, engaging around 12 crore people, mostly individual proprietorship/Own Account Enterprises. Over 60% of units are owned by persons belonging to Scheduled Caste, Scheduled Tribe or Other Backward Classes. Most of these units are outside the formal banking system, and hence are forced to borrow from informal sources or use their limited owned funds. MUDRA Loan Scheme has been proposed to bridge this gap. MUDRA Loan Scheme will aim to increase the confidence of the aspiring young person to become first generation entrepreneurs as also of existing small businesses to expand their activities.

2. Brief details of the Product

MUDRA loans are extended by banks, NBFCs, MFIs and other eligible financial intermediaries as notified by MUDRA Ltd. The Pradhan Mantri MUDRA Yojana (PMMY) announced by the Hon’ble Prime Minister on 8th April 2015, envisages providing MUDRA loan, upto ₹ 10 lakh, to income generating micro enterprises engaged in manufacturing, trading and services sectors. The overdraft amount of 5000 sanctioned under PMJDY has been also classified as MUDRA loans under Prime Minister MUDRA Yojana (PMMY). The MUDRA loans are extended under following three categories :

- Loans upto ₹ 50,000/- (Shishu)

- Loans from ₹ 50,001 to ₹ 5 lakh (Kishore)

- Loans from ₹ 5,00,001/- to ₹ 10 lakh (Tarun)

More focus would be given to Shishu.

Accordingly, all advances granted on or after 8th April 2015 falling under the above category are classified as MUDRA loans under the PMMY. The application forms for such loans shall also carry the name “Pradhan Mantri MUDRA Yojana”.

3. Eligible borrowers

- Individuals

- Proprietary concern.

- Partnership Firm.

- Private Ltd. Company.

- Public Company.

- Any other legal forms.

The applicant should not be defaulter to any bank or financial institution and should have a satisfactory credit track record. The individual borrowers may be required to possess the necessary skills/experience/ knowledge to undertake the proposed activity. The need for educational qualification, if any, need to be assessed based on the nature of the proposed activity, and its requirement.

4. Purpose of Assistance/Nature of assistance.

Need based term loan/OD limit/composite loan to eligible borrowers for acquiring capital assets and/or working capital/marketing related requirements. The MUDRA loans are provided for income generating small business activity in manufacturing, processing, service sector or trading. The Project cost is decided based on

business plan and the investment proposed. MUDRA loan is not for consumption/personal needs. For the purpose of working capital limit, MUDRA has launched a new product called “MUDRA Card”, which is a Debit card issued on RuPay platform, and provides hassle free credit in a flexible manner.

5. Amount of assistance

Upto to ₹ 10 lakh in three categories viz. Shishu, Kishore and Tarun.

6. Margin/Promoters Contribution

Margin/Promoters Contribution is as per the policy framework of the bank, based on overall guidelines of RBI in this regard. Banks may not insist for margin for Shishu loans.

7. Interest rate

Interest rates are to be charged as per the policy decision of the bank. However, the interest rate charged to ultimate borrowers shall be reasonable. Scheduled Commercial Banks, RRBs and Cooperative Banks wishing to avail of refinance from MUDRA will have to peg their interest rates, as advised by MUDRA Ltd., from time to time.

8. Upfront fee/Processing charges.

Banks may consider charging of upfront fee as per their internal guidelines. The upfront fee/processing charges for Shishu loans are waived by most banks.

9. Security

A. First charge on all assets created out of the loan extended to the borrower and the assets which are directly associated with the business/project for which credit has been extended.

B. DPN (wherever applicable).

C. CGTMSE (wherever felt desirable)/MUDRA Guarantee cover (as and when introduced).

In terms of RBI guidelines issued vide Master Circular on lending to MSME Sector (para 4.2) dated July 01, 2014, in respect of loans upto ₹10 lakh,

banks are mandated not to accept collateral security in the case of loans upto ₹ 10 lakh extended to units in the Micro Small Enterprises (MSE) Sector. Banks are required to encourage their branch level functionaries to avail of the Credit Guarantee Scheme cover, wherever felt desirable.

10. Tenor of Assistance Based on the economic life of the assets created and also the cash flowgenerated. However, MUDRA’s refinance assistance will be for a maximumtenor of 36 months which will also be aligned to terms of allotment of MUDRA funds by RBI from time to time

11. Repayment

Term Loan :- To be repaid in suitable installments with suitable moratorium period as per cash flow of the business.

OD & CC Limit : Repayable on demand. Renewal and Annual Review as per internal guidelines of the Bank.

12. Availability of the loan

Mudra loan under PMMY is available at all bank branches across the country. Mudra loan is also issued by NBFCs / MFIs who are engaged in financing for micro enterprises in small business activities.

CREDIT GUARANTEE FUND SCHEME FOR MICRO AND SMALL ENTERPRISES

Introduction

There are an estimated 26 million micro and small enterprises (MSEs) in the country providing employment to an estimated 60 million persons. The MSE sector contributes about 45% of the manufacturing sector output and 40 % of the nation’s exports. Of all the problems faced by the MSEs, non- availability of timely and adequate credit at reasonable interest rate is one of the most important. One of the major causes for low availability of bank finance to this sector is the high risk perception of the banks in lending to MSEs and consequent insistence on collaterals which are not easily available with these enterprises. The problem is more serious for micro enterprises requiring small loans and the first generation entrepreneurs.

The Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGMSE) was launched by the Government of India to make available collateral-free credit to the micro and small enterprise sector. Both the existing and the new enterprises are eligible to be covered under the scheme. The Ministry of Micro, Small and Medium Enterprises and Small Industries Development Bank of India (SIDBI), established a Trust named Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) to implement the Credit Guarantee Fund Scheme for Micro and Small Enterprises. The scheme was formally launched on August 30, 2000 and is operational with effect from 1st January 2000. The corpus of CGTMSE is being contributed by the Government and SIDBI in the ratio of 4:1 respectively and has contributed Rs.1906.55 crore to the corpus of the Trust up to March 31,2010. As announced in the Package for MSEs, the corpus is to be raised to Rs.2500 crore by the end of 11th Plan.

Eligible Lending Institutions.

The institutions, which are eligible under the scheme, are scheduled commercial banks (Public Sector Banks/Private Sector Banks/Foreign Banks) and select Regional Rural Banks (which have been classified under ‘Sustainable Viable’ category byNABARD). National Small Industries Corporation Ltd. (NSIC), North Eastern Development Finance Corporation Ltd. (NEDFi) and SIDBI have also been made eligible institutions. As on March 31, 2010, there were 112 eligible Lending Institutions registered as (MLIs) of the Trust, comprising of 27 Public Sector Banks, 16 Private Sector Banks, 61 Regional Rural Banks, 2 Foreign Bank and 6 other Institutions viz., NSIC, NEDFI, SIDBI and The Tamil Nadu Industrial Investment Corporation(TNIIC).

Eligible Credit Facility

The credit facilities which are eligible to be covered under the scheme are both term loans and working capital facility up to Rs.100 lakh per borrowing unit, extended without any collateral security or third party guarantee, to a new or existing micro and small enterprise. For those units covered under the guarantee scheme, which may become sick owing to factors beyond the control of management, rehabilitation assistance extended by the lender could also be covered under the guarantee scheme. It is noteworthy that if the credit facility exceeds Rs.50 lakh, it may still be covered under the scheme but the guarantee cover will be extended for credit assistance of Rs.50 lakh only. Another important requirement under the scheme is that the credit facility

should be availed by the borrowing unit from a single lending institution. However, the unit already assisted by the State Level Institution/NSIC/NEDFi can be covered under the scheme for the credit facility availed from member bank, subject to fulfillment of other eligibility criteria. Any credit facility in respect of which risks are additionally covered under a scheme, operated by Government or other agencies, will not be eligible for coverage under the scheme.

Guarantee Cover

The guarantee cover available under the scheme is to the extent of 75 percent of the sanctioned amount of the credit facility. The extent of guarantee cover is 80 per cent for (i) micro enterprises for loans up to Rs.5 lakh; (ii) MSEs operated and/or owned by women; and (iii) all loans in the North-East Region. In case of default, Trust settles the claim up to 75% (or 80% wherever applicable) of the amount in default of the credit facility extended by the lending institution. For this purpose the amount in default is reckoned as the principal amount outstanding in the account of the borrower, in respect of term loan, and amount of outstanding working capital facilities, including interest, as on the date of the account turning Non-Performing Asset (NPA).

Tenure of Guarantee

The Guarantee cover under the scheme is for the agreed tenure of the term loan/composite credit. In case of working capital, the guarantee cover is of 5 years or block of 5 years.

Fee for Guarantee

The fee payable to the Trust under the scheme is one-time guarantee fee of 1.5% and annual service fee of 0.75% on the credit facilities sanctioned. For loans up to Rs.5 lakh, the one-time guarantee fee and annual service fee is 1% and 0.5% respectively. Further, for loans in the North-East Region, the one-time guarantee fee is only 0.75%.

Website

Operations of CGTMSE are conducted through Internet. The website of CGTMSE has been hosted at www.cgtsi.org.in. Scheme Awareness Programmes

CGTMSE has adopted multi-channel approach for creating awareness about its guarantee scheme amongst banks, MSE associations, entrepreneurs, etc. through print and electronic media, by conducting workshops/seminars, attending meetings convened at various district/state/national fora, etc. As on March 31,2010, 1080 workshops and seminars were conducted on Credit Guarantee Scheme. Also, CGTMSE participated in 19 exhibitions and attended 304 SLBC/meetings convened by RBI/other Government offices. Posters and mailers have been circulated to banks, industry associations, and other stakeholders for promoting the scheme and creating its greater awareness. With a view to imparting training to MLIs through their training colleges, multimedia CD-ROM containing operational modalities of the scheme, was distributed to the staff training centers/colleges of the MLIs. The Trust has recently launched an advertisement campaign in 194 newspapers across the country through DAVP, which has created considerable awareness about the scheme among the target audience. Operational Highlights of CGTMSE

Operational Highlights of CGTMSE

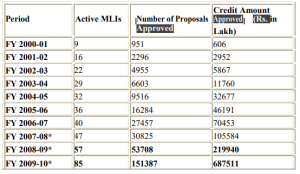

As on March 31, 2010, 3,00,105 proposals from micro and small enterprises have been approved for guarantee cover for aggregate credit of Rs.11550.61 crore, extended by 85 MLIs in 35 States/UTs. A year-wise growth position is indicated in the table below:

Scheme of Micro Finance Programme

The Government has launched a Scheme of Micro Finance Programme in 2003-04.The Scheme has been tied up with the existing programme of SIDBI by way of contributing towards security deposits required from the MFIs/NGOs to get loan from SIDBI.The scheme is being operated in underserved States and underserved pockets/districts of other states. The Government of India provide funds for Micro-Finnance Programme to SIDBI, which is called ‘Portfolio Risk Fund'(PRF).At present SIDBI takes fixed deposit equal to 10% of the loan amount.The share of MFIs/NGOs is 2.5% of the loan amount (i.e. 25% of security deposit) and balance 7.5%(i.e. 7.5% of security deposite) is adjusted from the funds provided by the Government of India. As on 31st March 2010, the Government has released an amount of Rs.80.00 crore towards ‘Portfolio Risk Fund'(PRF).An amount of Rs .6.00 crore has been released during 2009-10. As on 31st march 2010,cumulative loan amount of Rs.1299.68 crore has been provided to MFIs/NGOs under the Scheme benefiting approximately 20.21 lakh persons. Of this,more than 80% are estimated to be women beneficiaries.